5 Best Cryptocurrency Exchanges in 2024

1. Introduction:-

Brief overview of the cryptocurrency landscape

- Importance of choosing the right cryptocurrency exchan

2. Understanding Cryptocurrency Exchanges:-

- Different types of exchanges (centralized, decentralized)

- Factors to consider when selecting an exchange

*Types of Exchanges*

1. Centralized Exchanges (CEX):

Centralized exchanges, commonly known as CEX, operate as intermediaries between buyers and sellers. These platforms manage and control users’ funds, acting as custodians. Some key characteristics include:

- User-Friendly Interface: CEX platforms usually offer intuitive interfaces, making them accessible for beginners.

- Liquidity: Centralized exchanges often boast high liquidity due to a large user base.

- Regulatory Compliance: Many CEX comply with regulatory standards, providing a sense of security for users.

2. Decentralized Exchanges (DEX):

Decentralized exchanges, or DEX, function without a central authority, allowing users to trade directly with each other. Here are some notable features:

- User Control: DEX provides users with more control over their funds, as transactions occur directly between wallets.

- Privacy: Users on DEX platforms often enjoy a higher degree of privacy and anonymity.

- Security: Decentralization reduces the risk of hacking, as there’s no central point of vulnerability.

Factors to Consider When Selecting an Exchange:

1. Security:

The security of your funds should be a top priority. Look for exchanges with robust security measures, such as two-factor authentication (2FA) and cold storage for cryptocurrencies.

2. User Interface and Experience:

Consider the user-friendliness of the exchange, especially if you are a beginner. An intuitive interface can make the trading process smoother and more enjoyable.

3. Supported Cryptocurrencies:

Different exchanges support different cryptocurrencies. Ensure that the exchange you choose supports the specific digital assets you intend to trade.

4. Transaction Fees:

Examine the fee structure of the exchange, including trading fees, withdrawal fees, and any other associated costs. High fees can significantly impact your overall returns.

5. Liquidity:

Liquidity is crucial for efficient trading. Higher liquidity often means that you can buy or sell assets more quickly at more favorable prices.

6. Regulatory Compliance:

Check if the exchange complies with relevant regulations in your jurisdiction. Regulatory compliance adds an extra layer of security and legitimacy to the platform.

7. Customer Support:

In the fast-paced crypto market, reliable customer support is vital. Choose an exchange with responsive customer service to address any issues or concerns promptly.

8. Reputation:

Research the reputation of the exchange within the crypto community. Reviews and testimonials from other users can provide valuable insights into the reliability and trustworthiness of the platform.

As you venture into the exciting world of cryptocurrency trading, keeping these factors in mind will empower you to make informed decisions, ensuring a secure and seamless experience on the chosen exchange.

3. Top Cryptocurrency Exchanges for 2024

Binance

Coinbase

Kraken

Gemini

Bitstamp

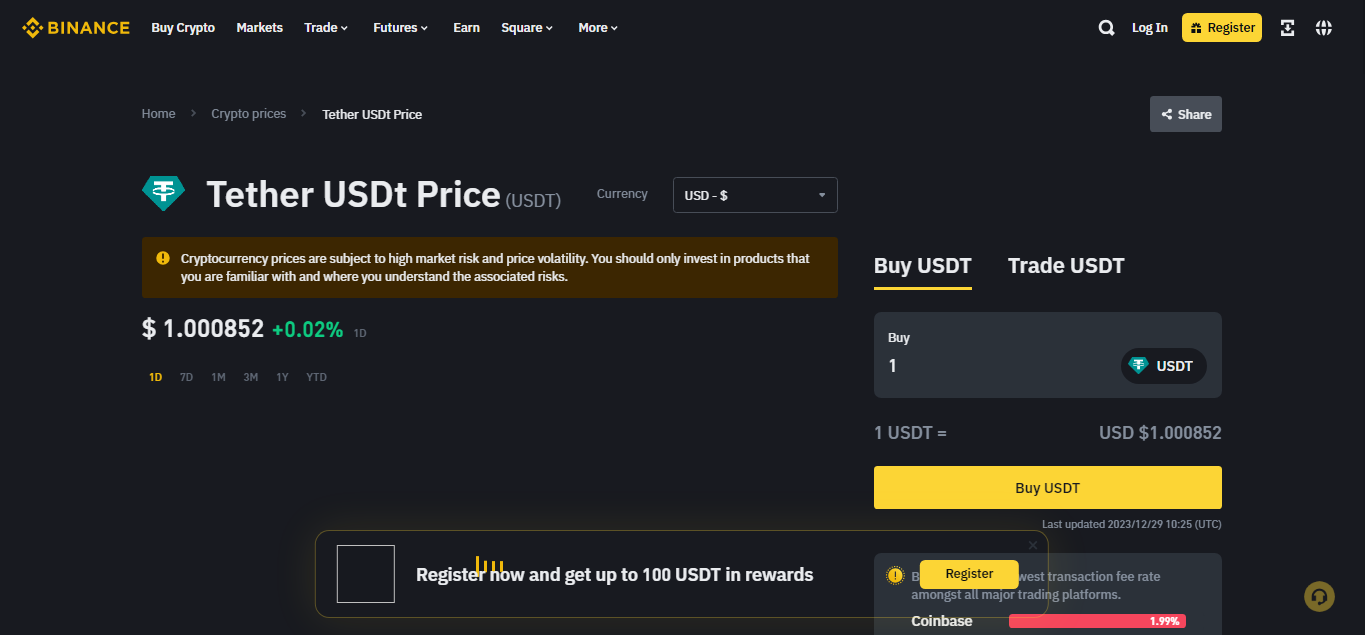

4. Binance: A Closer Look

- Features and benefits

- User interface and experience

*Features and Benefits*:

1. Wide Range of Cryptocurrencies:

Binance boasts an extensive selection of cryptocurrencies available for trading. From well-established tokens like Bitcoin and Ethereum to promising altcoins, users have the flexibility to diversify their portfolios.

2. Low Trading Fees:

One of the key attractions of Binance is its competitive fee structure. The platform offers relatively low trading fees, making it cost-effective for users, especially those engaged in frequent trading activities.

3. Binance Coin (BNB):

Binance has its native cryptocurrency, Binance Coin (BNB). Users can use BNB to pay for trading fees at a discounted rate, providing an additional incentive to hold and use this native token.

4. Security Measures:

Security is a top priority for Binance. The exchange employs industry-leading security practices, including two-factor authentication (2FA) and cold storage of funds, ensuring the safety of users’ assets.

5. Advanced Trading Options:

For experienced traders, Binance offers advanced trading features such as spot trading, futures trading, and margin trading. These options cater to users with varying levels of expertise and risk tolerance.

6. Leverage and Derivatives:

Binance provides users with the option to trade with leverage, enhancing potential profits (or losses). Additionally, the platform offers a range of derivative products, allowing users to speculate on price movements without owning the underlying assets.

User Interface and Experience:

1. Intuitive Interface:

Binance’s user interface is designed with user experience in mind. The platform offers a clean and intuitive layout, making it easy for both beginners and experienced traders to navigate the site seamlessly.

2. Mobile-Friendly App:

Recognizing the importance of accessibility, Binance offers a mobile app that mirrors the functionality of the web platform. Users can trade on the go, ensuring they don’t miss out on market opportunities.

3. Educational Resources:

Binance provides educational resources for users at all levels. From basic tutorials for beginners to advanced trading strategies, the exchange supports continuous learning within the crypto community.

4. Customer Support:

Binance offers responsive customer support to address user queries and concerns. The platform understands the importance of timely assistance in the fast-paced crypto market.

5. Community Engagement:

Binance actively engages with its community through social media channels and forums. This transparent communication fosters a sense of trust and community among its user base.

In conclusion, Binance’s robust features, low fees, and user-friendly interface make it a powerhouse in the cryptocurrency exchange landscape. Whether you’re a casual investor or a seasoned trader, Binance provides the tools and resources needed to navigate the exciting world of digital assets.

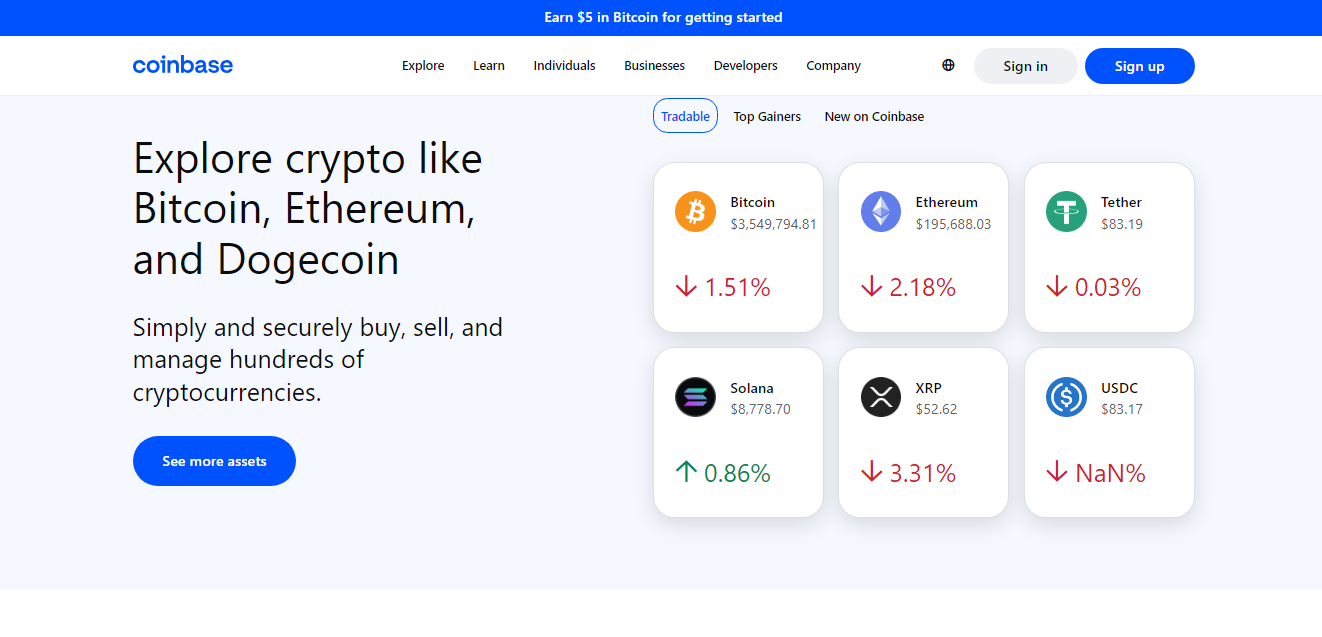

5. Coinbase: The Go-To Exchange for Beginners

- Ease of use and accessibility

- Supported cryptocurrencies

**Ease of Use and Accessibility**:

1. User-Friendly Interface:

Coinbase is renowned for its intuitive and user-friendly interface. The platform’s design is clean and straightforward, making it easy for beginners to navigate and execute trades without feeling overwhelmed.

2. Simplified Onboarding:

The onboarding process on Coinbase is designed with beginners in mind. Setting up an account is a seamless experience, and the platform guides users through the necessary steps to start trading quickly.

3. One-Stop Solution:

Coinbase functions as a one-stop solution for users, combining a wallet, exchange, and various educational resources in one platform. This consolidation simplifies the cryptocurrency journey, especially for those who are new to the space.

4. Mobile App Accessibility:

Recognizing the importance of accessibility, Coinbase provides a mobile app that mirrors the web platform’s functionality. Users can conveniently manage their portfolios and execute trades on the go.

Supported Cryptocurrencies:

1. Diverse Cryptocurrency Offerings:

While initially focused on major cryptocurrencies like Bitcoin and Ethereum, Coinbase has expanded its offerings to include a diverse range of altcoins. This allows users to explore and invest in various digital assets within the same platform.

2. Stablecoin Support:

Coinbase supports stablecoins like USD Coin (USDC), providing users with a stable and reliable digital representation of fiat currency. This feature is particularly beneficial for those seeking to hedge against market volatility.

3. Regular Addition of New Assets:

To cater to evolving market trends, Coinbase regularly adds new cryptocurrencies to its platform. This ensures that users have access to a growing array of digital assets, keeping the platform relevant in the dynamic crypto landscape.

4. Educational Resources:

Coinbase goes beyond just being an exchange by providing educational resources for users. Beginners can access tutorials, articles, and videos to enhance their understanding of cryptocurrencies and blockchain technology.

6. Kraken: Balancing Security and Functionality

- Security measures

- Trading options available

**Kraken: Balancing Security and Functionality**

Kraken, a prominent cryptocurrency exchange, has carved a niche for itself by striking a delicate balance between robust security measures and a broad range of trading functionalities. Let’s delve into what makes Kraken a preferred platform for users seeking both safety and diverse trading options.

Security Measures:

1. Two-Factor Authentication (2FA):

Kraken prioritizes user security with the implementation of two-factor authentication (2FA). This additional layer of protection ensures that even if login credentials are compromised, unauthorized access remains highly unlikely.

2. Cold Storage of Funds:

Kraken employs a significant security feature by storing the majority of user funds in cold wallets. Cold storage, which is not connected to the internet, reduces the risk of hacking and unauthorized access, enhancing the overall safety of user assets.

3. Encrypted Communication:

To safeguard user data during transactions, Kraken utilizes encrypted communication protocols. This ensures that sensitive information remains confidential and protected from potential security threats.

4. Regulatory Compliance:

Kraken demonstrates a commitment to regulatory compliance, adhering to legal standards and industry regulations. This not only instills confidence in users but also positions Kraken as a trustworthy and transparent player in the cryptocurrency space.

Trading Options Available:

1. Spot Trading:

Kraken offers a traditional spot trading platform where users can buy and sell various cryptocurrencies at current market prices. This straightforward option caters to both beginners and experienced traders.

2. Futures Trading:

For users seeking more advanced trading strategies, Kraken provides futures trading options. Futures contracts allow traders to speculate on the future price of assets, enabling potential profits even in a bear market.

3. Margin Trading:

Kraken’s margin trading feature allows users to borrow funds to increase their trading position. While it magnifies potential profits, it’s essential for users to be aware of the increased risk associated with margin trading.

4. Wide Range of Cryptocurrencies:

Kraken supports an extensive array of cryptocurrencies, providing users with ample options for diversification. From popular coins like Bitcoin and Ethereum to lesser-known altcoins, the platform caters to a broad spectrum of investor preferences.

5. Security Token Offerings (STOs):

Kraken goes beyond standard cryptocurrencies by offering Security Token Offerings. STOs represent ownership of assets and adhere to regulatory frameworks, providing users with an avenue to invest in tokenized real-world assets.

7. Gemini: A Regulated and Trustworthy Platform

- Regulatory compliance

- Fiat currency support

**Regulatory Compliance**:

1. Licensed and Regulated:

Gemini is one of the few cryptocurrency exchanges that operate with regulatory approval. It is licensed by the New York State Department of Financial Services (NYDFS) and complies with regulatory standards, ensuring a high level of transparency and accountability.

2. AML and KYC Compliance:

To prevent illicit activities and ensure user security, Gemini enforces Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance. These measures require users to verify their identity, promoting a secure and compliant trading environment.

3. Data Protection:

Gemini places a strong emphasis on data protection. The platform employs encryption protocols to safeguard user data, ensuring that sensitive information remains confidential and secure from potential cyber threats.

4. Regulatory Engagement:

Gemini actively engages with regulators and policymakers to contribute to the development of a regulatory framework for the cryptocurrency industry. This proactive approach not only fosters regulatory goodwill but also positions Gemini as a responsible and compliant player in the market.

Fiat Currency Support:

1. USD Trading Pairs:

Gemini supports a range of fiat-to-cryptocurrency trading pairs, with a primary focus on the United States Dollar (USD). This allows users to easily convert their fiat currency into various digital assets without relying on third-party exchanges.

2. Bank Integration:

Gemini has established seamless integration with banks, facilitating fiat deposits and withdrawals. Users can link their bank accounts to the platform, streamlining the process of transferring funds between traditional financial institutions and the cryptocurrency exchange.

3. Stablecoin (GUSD):

Gemini introduced its own stablecoin, the Gemini Dollar (GUSD). Pegged to the value of the US Dollar, GUSD provides users with a stable and trustworthy digital representation of fiat currency on the blockchain.

4. Fiat Onramps and Offramps:

Gemini serves as a reliable fiat onramp and offramp, allowing users to transition between the cryptocurrency and traditional financial ecosystems seamlessly. This is particularly beneficial for those looking to enter or exit the cryptocurrency market with ease.

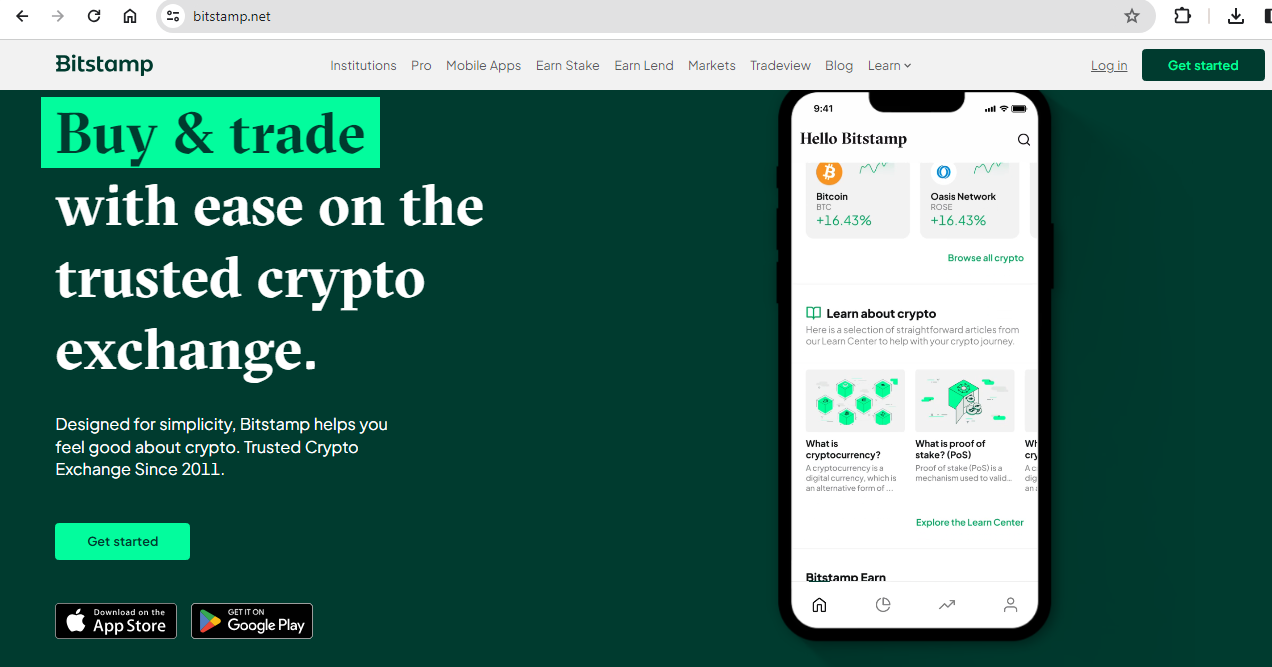

8. Bitstamp: A Pioneer in the Cryptocurrency Space

- Track record and reputation

- Special features offered

**Track Record and Reputation**:

1. Established in 2011:

Bitstamp holds the distinction of being one of the longest-standing cryptocurrency exchanges, having been established in 2011. This longevity speaks to its resilience and adaptability in an ever-evolving market.

2. Proven Stability:

Over the years, Bitstamp has demonstrated exceptional stability and reliability. The platform has weathered market fluctuations and technological changes, earning the trust of users through consistent and secure service.

3. Global User Base:

Bitstamp’s global user base attests to its widespread recognition and acceptance. Traders from various regions trust the platform, contributing to its reputation as a reliable and accessible exchange for cryptocurrency transactions.

4. Regulatory Compliance:

Bitstamp operates with a commitment to regulatory compliance. The exchange has obtained licenses from regulatory authorities, instilling confidence in users and positioning itself as a responsible and law-abiding entity in the crypto space.

Special Features Offered:

1. FIAT Currency Support:

Bitstamp facilitates the trading of various cryptocurrencies against fiat currencies, including the Euro (EUR) and the United States Dollar (USD). This fiat support enhances accessibility and allows users to seamlessly transition between traditional and digital assets.

2. Liquidity:

Bitstamp boasts high liquidity, providing traders with the advantage of executing orders quickly and at favorable market prices. This liquidity is a crucial feature for both novice and experienced traders seeking efficiency in their transactions.

3. Advanced Trading Options:

For traders with a more sophisticated approach, Bitstamp offers advanced trading options. These include features like limit orders, stop orders, and margin trading, catering to users with varying levels of expertise and risk tolerance.

4. Mobile App Accessibility:

Recognizing the importance of accessibility, Bitstamp provides a mobile app that allows users to trade on the go. The app mirrors the functionality of the web platform, ensuring that users can manage their portfolios wherever they are.

5. Corporate Accounts:

Bitstamp accommodates corporate clients, providing specialized services for institutional trading. This feature sets Bitstamp apart as an exchange that caters not only to individual traders but also to businesses and institutions.

9. Medium-Term Cryptocurrency Investment Strategies

- Holding vs. trading

- Diversification of investment

**Holding vs. Trading**:-

1. Holding (HODLing):

- Strategy: Holding involves purchasing cryptocurrencies with the intention of keeping them for an extended period, typically months or even years.

- Benefits:

- Long-Term Growth Potential: Historically, many cryptocurrencies have shown significant long-term growth, rewarding those who patiently hold through market fluctuations.

- Reduced Transaction Costs: Holding minimizes the impact of transaction fees associated with frequent trading.

- Considerations:

- Market Volatility: While holding can lead to substantial gains, it also requires enduring market volatility without reacting emotionally.

- Research and Analysis: Thoroughly researching and understanding the fundamentals of the chosen cryptocurrencies is vital for successful holding.

2. Trading:

- Strategy: Trading involves actively buying and selling cryptocurrencies within shorter time frames to capitalize on price movements.

- Benefits:

- Profit from Market Fluctuations: Traders can profit from both upward and downward price movements by executing well-timed trades.

- Adaptability: Traders can adjust their strategies based on market trends and news, potentially maximizing short-term gains.

- Considerations:

- Risk Management: Trading involves higher risks due to the potential for losses if the market moves against the trader.

- Time Commitment: Successful trading often requires constant monitoring of the market, making it time-intensive.

Diversification of Investment:

1. Spread Across Cryptocurrencies:

- Strategy: Diversification entails spreading investments across various cryptocurrencies rather than concentrating on a single asset.

- Benefits:

- Risk Mitigation: Diversification helps reduce risk by not being overly dependent on the performance of a single cryptocurrency.

- Exposure to Different Sectors: Investing in diverse cryptocurrencies provides exposure to various blockchain projects and sectors within the crypto space.

- Considerations:

- Research and Due Diligence: Understanding the unique characteristics and potential of each chosen cryptocurrency is essential for effective diversification.

- Regular Portfolio Review: Periodically reassessing the portfolio and adjusting diversification based on market trends and individual asset performance is crucial.

2. Allocation Across Asset Classes:

- Strategy: Beyond diversification within cryptocurrencies, consider allocating investments across different asset classes, including stablecoins, decentralized finance (DeFi) tokens, and established cryptocurrencies.

- Benefits:

- Stability: Including stablecoins can provide stability to the portfolio during times of high market volatility.

- Exposure to Innovation: Allocating funds to emerging sectors like DeFi allows investors to participate in the innovative developments within the cryptocurrency space.

- Considerations:

- Risk-Return Profile: Balancing risk and potential returns is key when allocating investments across different asset classes.

- Adaptability: Be ready to adjust the allocation based on the evolving cryptocurrency market and broader economic conditions.

10. The Benefits of Using Cryptocurrency Exchanges

- Liquidity and market access

- Security measures in place

Liquidity and Market Access:

1. Enhanced Liquidity:

- Efficient Trading: Cryptocurrency exchanges contribute to market liquidity by bringing together a multitude of buyers and sellers. This high liquidity ensures that users can execute trades swiftly at competitive market prices.

- Reduced Price Slippage: The liquidity provided by exchanges minimizes price slippage, enabling users to execute trades without significant impact on the asset’s price.

2. Global Market Access:

- Accessibility: Cryptocurrency exchanges operate 24/7, allowing users to trade at any time, regardless of their geographic location. This accessibility breaks down traditional market barriers and fosters a truly global trading environment.

- Diverse Asset Offerings: Exchanges often host a wide variety of cryptocurrencies, giving users access to a diverse range of digital assets beyond the well-known Bitcoin and Ethereum.

- Fiat Onramps and Offramps: Many exchanges support fiat-to-crypto trading pairs, facilitating the seamless transition between traditional currencies and digital assets. This feature broadens market access and encourages wider participation.

Security Measures in Place:

1. Two-Factor Authentication (2FA):

- Enhanced User Security: Cryptocurrency exchanges prioritize user security by implementing two-factor authentication (2FA). This additional layer of verification protects accounts from unauthorized access, enhancing the overall safety of user funds.

2. Cold Storage of Funds:

- Reduced Hacking Risk: Leading exchanges employ cold storage solutions, storing the majority of user funds offline. This precautionary measure mitigates the risk of hacking attempts as the assets are not directly accessible from the internet.

3. Encryption Protocols:

- Secured Communication: Exchanges utilize advanced encryption protocols to secure the communication channels between users and the platform. This encryption safeguards sensitive information, such as login credentials and transaction data.

4. Regulatory Compliance:

- Trust and Legitimacy: Exchanges that adhere to regulatory standards inspire trust and legitimacy. Compliance with applicable regulations ensures that exchanges operate within legal frameworks, fostering a sense of security among users.

5. Regular Security Audits:

- Continuous Improvement: Reputable exchanges conduct regular security audits and assessments to identify vulnerabilities. This proactive approach demonstrates a commitment to continuous improvement in security protocols.

My brother suggested I might like this blog He was totally right This post actually made my day You can not imagine simply how much time I had spent for this info Thanks

Thank you

I was recommended this website by my cousin I am not sure whether this post is written by him as nobody else know such detailed about my trouble You are amazing Thanks

Thank you very much. Always stay in touch, and keep bringing even better blogs. Now, quickly, I need some more information. Please email me.